The goal of a two and a half hour McHenry County Board Finance Committee meeting whose main topic was next real estate taxes was stated by Vice Chairman Brian Sager:

“I hope we s a committee can come together to a consensus and move forward.”

Finance Committee and other County Board members attending the November 6th meeting while considering budget cuts.

The biggest consensus was that there was not a consensus to recommend the so-called “lookback” approach. Only three people said they favored it:

- Larry Smith

- Jim Kearns amd

- Gloria Van Hof

When the County Board put a referendum on the ballot to shift financing for the Mental Health Board from property taxes to sales taxes, most people thought that the over $11 million 708 Board levy would be subtracted from the previous year’s tax levy.

That did not happen.

Then, this year, county administrators bought forward a proposal to utilize a loophole in the Property Tax Cap allowing local governments to levy the highest amount taxed over the previous three years.

For shorthand, it was called the “lookback” approach.

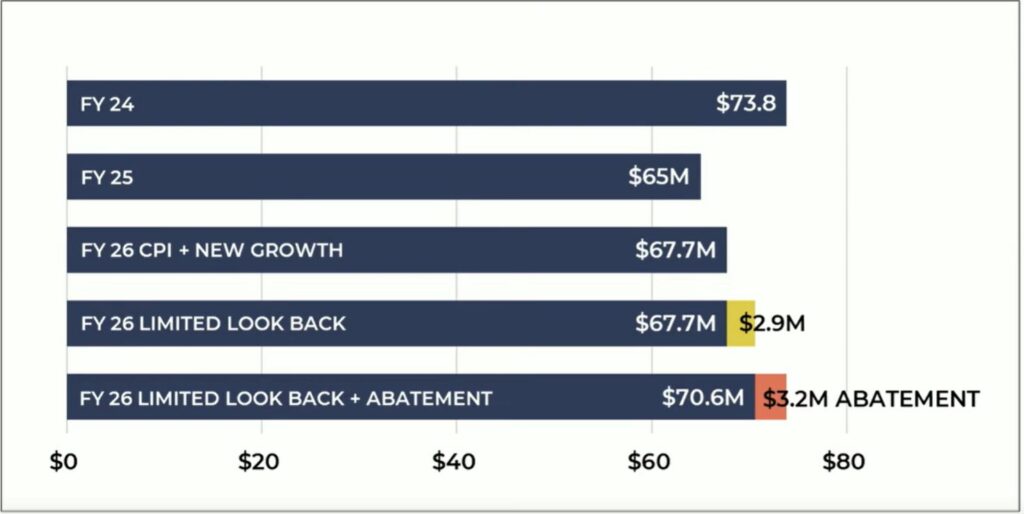

In the chart below one can see the highest levy was $73.8 million, which included the Mental Health Board amount. Note that the FY25 levy (taxes paid this year) was not reduced by the $11 million Mental Health levy from FY24. Sheriff squad cars, among other General Fund expenditures eliminated the mission millions.

To ameliorate the lookback’s sticker shock, a $3.2 million abatement was suggested.

There were two other options under consideration:

- a flat levy, which would lower everyone’s taxes and

- taking the 2.9% CPI increase allowed under normal circumstances, plus new growth

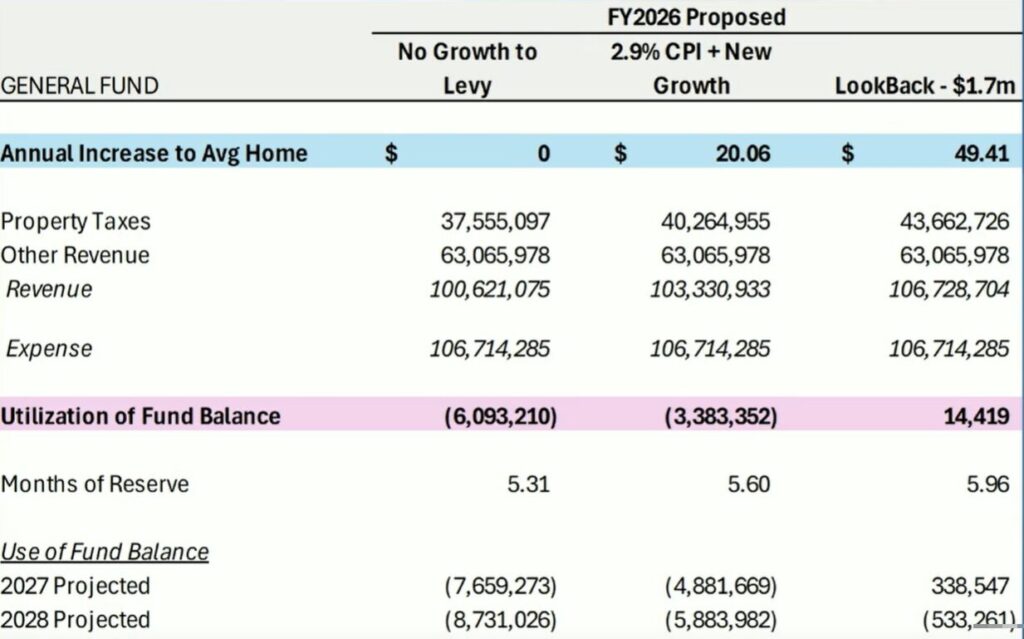

While a tax cut would result with a flat levy, under the 2.9% + new growth, the average home in McHenry County would see a 20$ tax hike from county government (on top of the other tax districts pretty much taxing to the max), while the lookback approach would hike county taxes by just under $50.

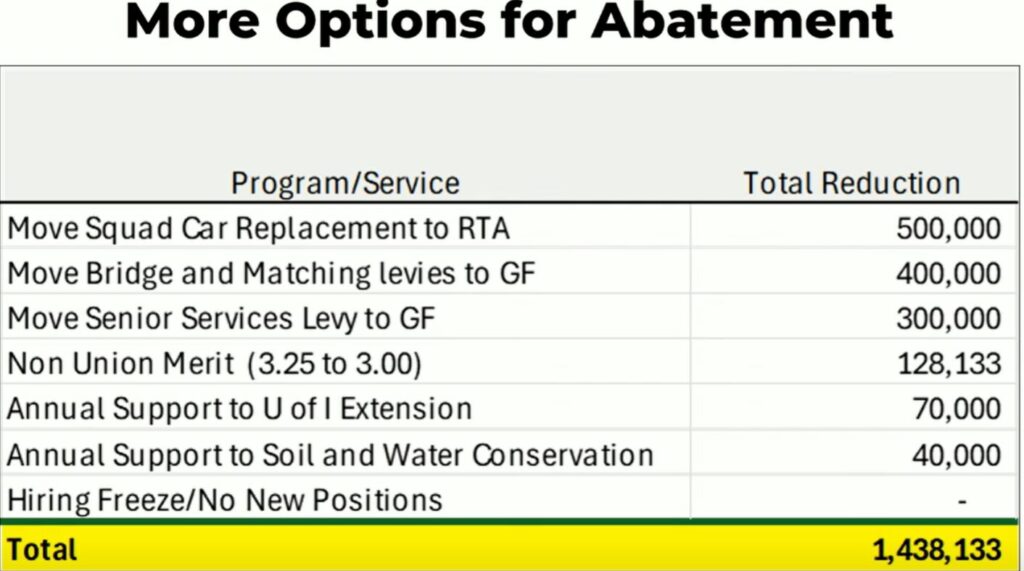

Additional possible abatements were brought forth from various sources, one mentioned specifically was County Board member Mike Shorten.

Much time was spent discussing the above possibilities of reducing the General Fund tax levy through a larger abatement than originally proposed.

With the major exception of Transportation Committee Chairman Jim Kearns, consensus was reached to go with the first big ticket item–utilizing RTA sales tax to pay for the squad cars this year.

The last RTA sales tax hike was engineered by then-State Senator Kirk Dillard, who convinced the legislature to allow a new local quarter of one percent RTA sales tax to be spent on law enforcement, rather than only on transpiration. His DuPage County needed money for that purpose.

McHenry County has so far used its share for transportation.

Kearns argued if squad cars for the Sheriff were to be financed from RTA sales taxes that it would end up not bring a one-time expenditure, but would end up being a long-time loss of funds from the Transportation Department.

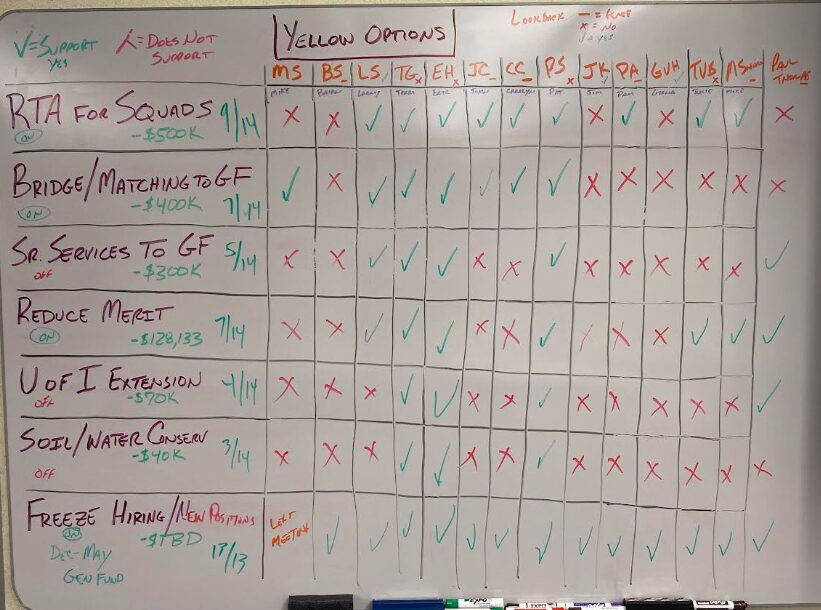

Below is the tally sheet for abatement options listed above:

As you can see above at the bottom of the tote board, consensus was reached on hiring freeze.

It was not until after Finance Committee Chairman Mike Skala had departed that Vice Chairman Sager got around to seeking the consensus which he sought at the beginning of the meeting.

And it was not until after people up for reelection started to agree with Pam Althoff when she said she was not ready to do more than “consider” the lookback approach that the consensus ball got rolling.

Althoff disagreed with the interpretation of the intent of the County Board when it put the Mental Health Sales Tax on the ballot.

Greeno contended what the County Board promised was to cut the almost $11 million Mental Health Property Tax levy from the County’s total.

Althoff had a different interpretation.

She did observe what might be her motivation of not signing on to the lookback approach:

“The other side will come back with ‘You raised my taxes.'”

Althoff has Democrat Sheryl Lindenbaum running against her in the fall.

Here are the people up for reelection who attended the meeting:

- Larry Smith

- Carolyn Campbell

- Pam Althoff

- Gloria Van Hof

- Mike Shorten

- Brain Sager

Smith, Kearns and Van Hof indicated support for the lookback approach.

Van Hof has no Republican opponent, but Smith has Maengo Park Board President Marty Mohr as Republican Primary Election opposition. There is also a Democrat running in the fall.

Besides not being ready to endorse the lookback approach, the only real consensus was that a flat tax levy, which would lower everyone’s taxes will no be considered at the upcoming Committee of the Whole meeting.

The levy will either reflect the 2.9% increase in the Consumer Price Index, plus the capturing of new construction growth or the lookback with an abatement.

Neither are taxpayer-friendly.

When the Crystal Lake Park Board decided to take the CPI, plus new growth, I headlined it as taxing to the max.

McHenry County Treasurer Donna Kurtz made a presentation which strongly supported the lookback approach.