McHenry County Treasurer Donna Kurtz has posted tax bills which will be mailed Wednesday, May 7th.

You can find yours here, half due June 10th, half due September 10th.

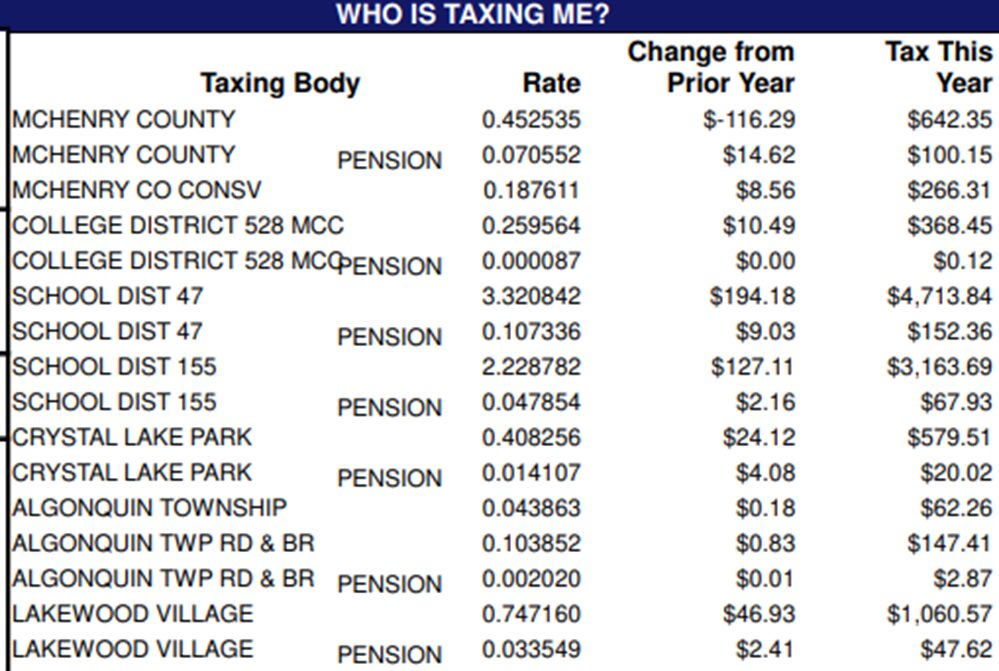

Our bill in Lakewood is $11,395.46, up $328.42 from last year.

Taxes would have been more if voters had not approved imposition of a sales tax to almost replace the property tax levied by county government for the 708 Mental Health Board.

And the County tax rate could have gone down more if the spenders on the McHenry County Board had not decided to gobble up part of the disappearing Mental Health Board levy for other purposes, instead of cutting elsewhere.

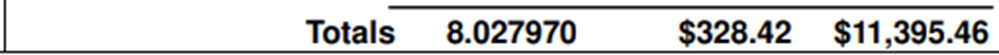

And, had the voters rejected the McHenry County Conservation District pitch to keep part of the bond payments being paid off, MCCD’s tax bill would have decreased substantially, instead of increasing.

GOP Requests “No” Vote on Conservation District Referendum to Gut the Tax Cap and Preserve a MCCD Tax Rate Cut of 60%

But, voters either did not see through the sneaky tax increase proposal or were hoodwinked by the over $200,000 campaign put on by MCCD tax hike supporters.

Sweat Equity vs. $204,000 in Conservation District Referendum Campaign to Hike Tax Rate by 33%

The tax hikers are spent more money than any candidate running for McHenry County office.

- From the McHenry County Conservation District Foundation – $150,000

- From Chicago-based Openlands – $25,000 in cash and $3,478.50 for the salary of Chicago resident Emily Reusswig

- From Chicago-based Trust for Public Land – $16,255.18 for the salary of Tallahassee resident Will Abberge

From individuals – only $5,000

You can see what parts of the county voted to increase Conservation District taxes here or below:

Not enough people followed the advice of the Libertarian Party and the Republican Party.

Calling All Masochists – Tax Bills Are Up | Dailywise

[…] Story continues […]

Real Estate Tax Bills in the Mail - McHenry County Blog

[…] Calling All Masochists – Tax Bills Are Up […]