From Illinois Policy:

No. 2 no more: Illinois property taxes rank highest in U.S

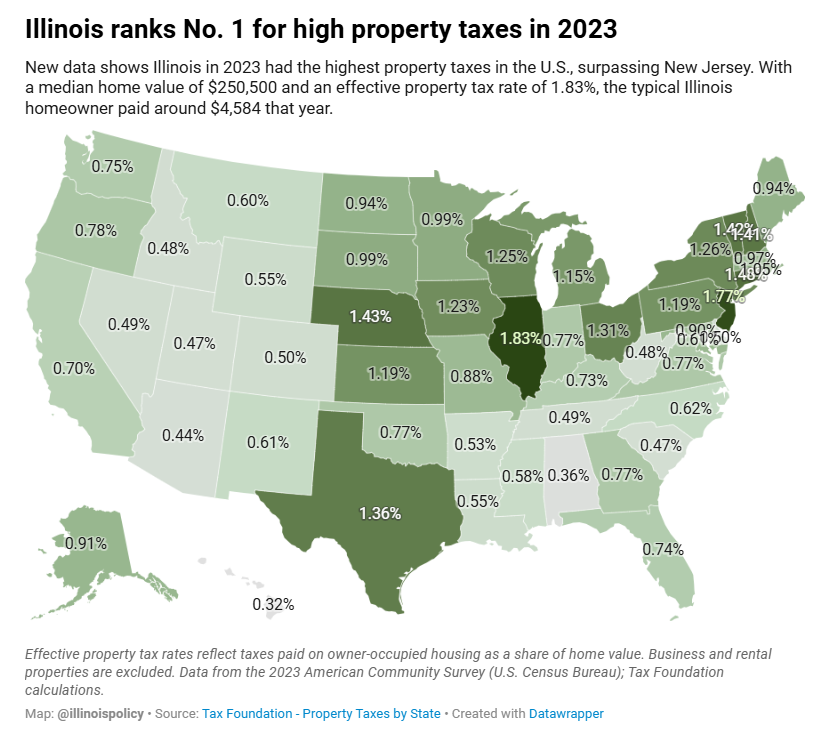

Illinois just ranked as having the highest property tax rate in the country. Property taxes in Illinois are an especially heavy burden without the tradeoff seen in states such as Texas or New Hampshire, where there are either no sales taxes or income taxes.

After years of ranking No. 2 to New Jersey, the latest data shows Illinoisans paid the highest property taxes in the nation during 2023. Worst, Illinoisans also pay steep income and sales taxes.

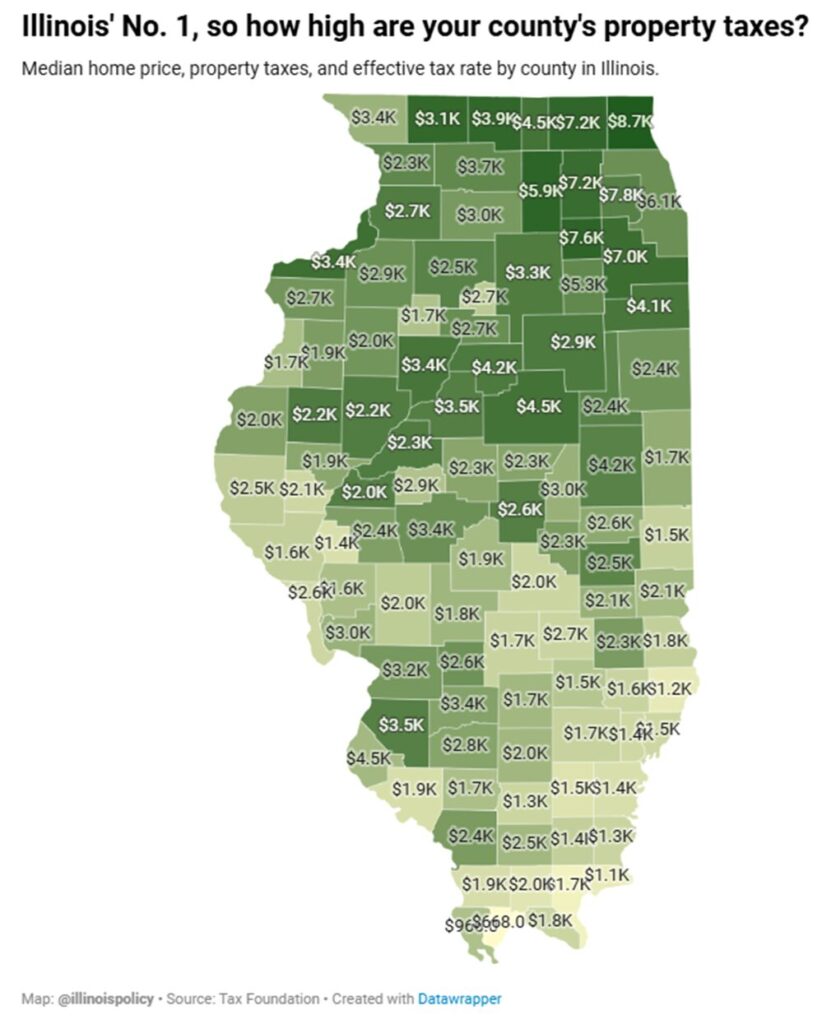

Illinois homeowners paid an average effective property tax rate of 1.83%, the highest in the nation. On a median-priced home of $250,500, that amounts to $4,584 per year. Neighboring states had significantly lower rates, making the idea of finding a home outside of Illinois appealing.

Property taxes are based on the idea that the people paying benefit from the services the taxes go to fund. Yet nearly 3-in-5 Illinoisans feel as if the value of public services they receive is not worth their high property taxes.

Are Illinois property taxes a reason Indianapolis and St. Louis are in the top 10 housing markets?

The disparity between taxes and services received stems from pension spending crowding out other essential services. In addition to limiting funding for key services, pensions are the leading force for driving up property taxes. Growing pension payments redirects money away from property tax relief or better public services.

Illinois lost population for nine consecutive years before revised Census Bureau estimates for 2023 showed the state population grew because of a massive spike in international migration that continued into 2024. Since 2020, 420,678 former Illinoisans have left the state in search of lower taxes and better opportunities.

Whether a homeowner or renter, high property taxes drive up housing costs for everyone. Illinois is one of the most tax-burdened states and lawmakers should pursue structural reform to keep Illinoisans at home.

A “hold harmless” pension reform plan, such as the one developed by the Illinois Policy Institute, offers a path to lower property taxes by targeting the root cause of rising property taxes: the state’s unfunded pension debt. Loosely based on bipartisan reforms from 2013, the plan ensures pensioners’ benefits are protected while easing the property tax burden.