Yesterday, McHenry County Blog printed McHenry County Board member John Collins’ critique of the letter Crystal Lake Park Board Feed Tiesenga proposed putting in the next Park District mailing to constituents.

Collins argued that the Park District is taking less money from homeowners because its tax rate has decreased over the last ten years.

He pointed out the tax rate showed “…a 19% decrease in the amount you pay per dollar of property value.

“That means our tax burden has become more efficient, not more expensive.”

But, tax rates are only half of the real estate equation.

The other half is assessments, which Collins addresses only in the aggregate:

“Since 2015, the value of taxable property in our district has increased by over 55%, from about $1.27 billion to nearly $1.97 billion today.“

But, really, no one cares what the rate or aggregate total assessed value is.

They care what their tax bill says.

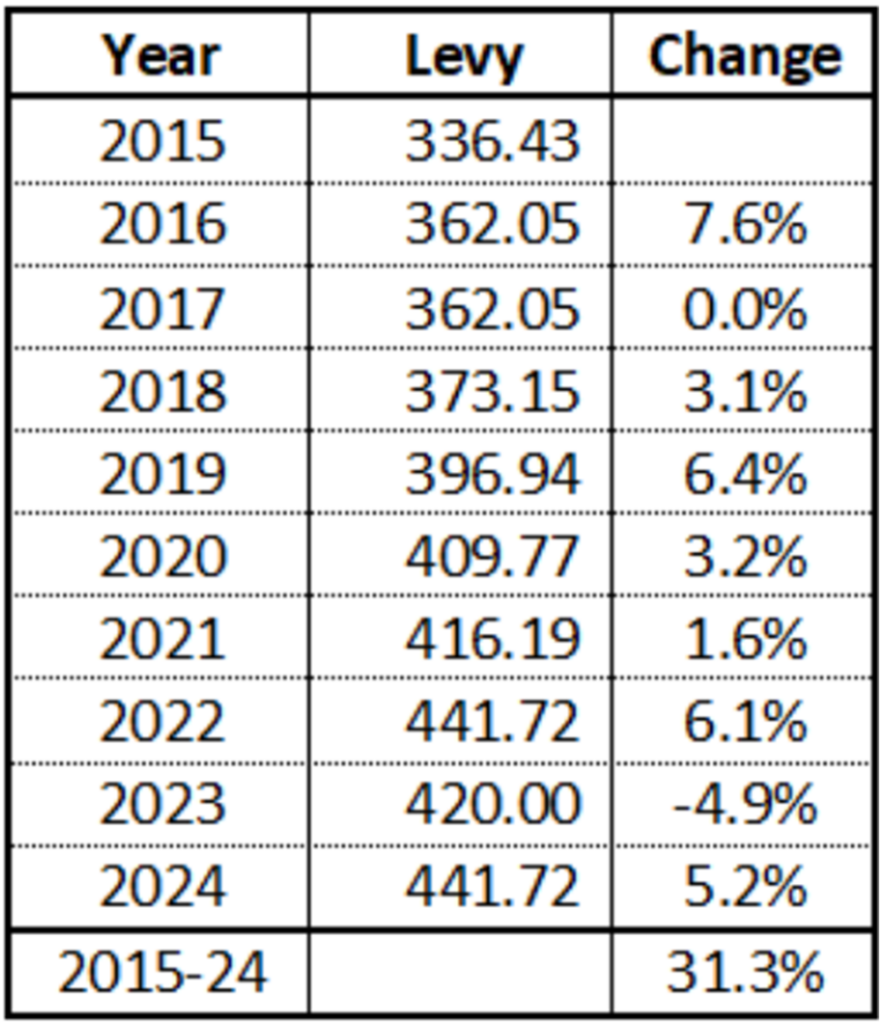

So, I decided to track the Collins’ family home’s dollar amount paid the Park District over the last ten years.

As one can see, the Collins’ Park District tax bill increased almost one-third over the last ten years.

A $105 increase.

Northwest Herald Features Rally in Support of Crystal Lake Park District Which Had No Mention of the Push to Buy HealthBridge - McHenry County Blog

[…] Critiquing John Collins’ Critique of Park Board President Fred Tiesenga’s Letter to Cons… […]