From a Friend of McHenry County Blog:

I did some work today on the tax burden on Illinois residents.

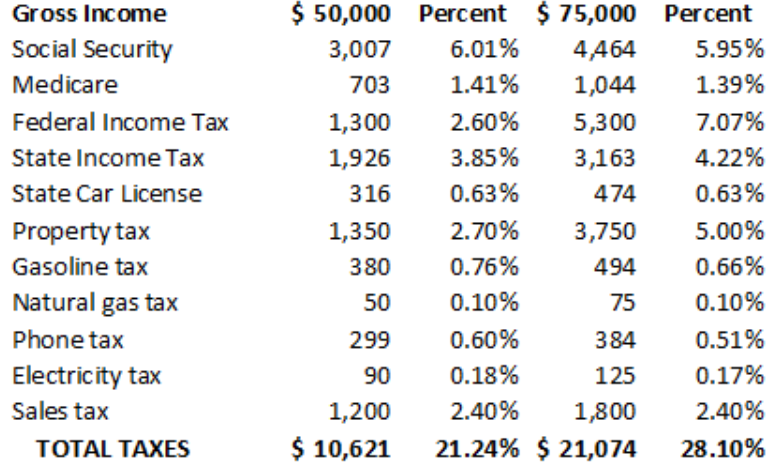

I figured the taxes on a family of four making $50,000, which is around the midpoint for the second quintile of income.

The Social Security, Medicare, and income taxes are straightforward.

For property taxes, I looked up property taxes by county in Illinois and found the average for households by income. This is the source: https://www.propertytax101.org/illinois/propertytaxbycounty

I looked up the tax rates on utilities (it’s about 18% for cell phones) and gasoline per gallon.

For sales tax, I looked up information on family spending by income level and then multiplied by the average state + local income tax rate, adjusting the rate for food.

I also figured the taxes for a family making $75,000, which is close to the median for Illinois.

They pay a lot more in income tax and a lot more in property taxes.