Illinois Policy has an article on how much local municipalities have “lost” because the state legislature did not continue the deal to pass the state income tax under the Richard B. Ogilvie administration (1969-73).

Then, to gain sufficient votes, those local governments were promised ten percent of the take.

My Public Finance Professor at the University of Michigan taught that taxes should be levied by the officials spending the money.

That clearly did not happen with the ten percent given by state officials to local officials.

So, I have no compassion for the entitlement mentality reflected in the article.

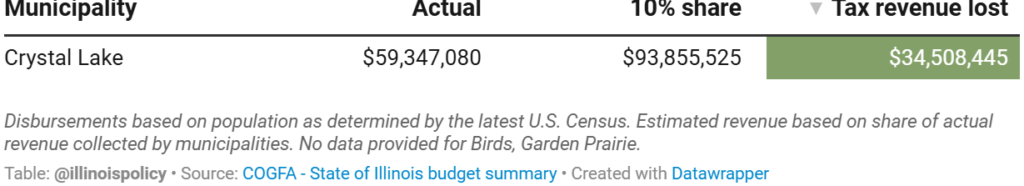

Illinois Policy did run the numbers for municipalizes and counties.

Figures for McHenry County municipalities, too low for the main article, are on a hidden table from which I have pulled the following:

“Lost Tax” amounts for other municipalities follow:

- Algonquin -$25,449,192

- Barrington Hills – $3,584,944

- Bull Valley – $935,904

- Cary – $15,417,774

- Fox Lake – $9,089,049

- Fox River Grove – $4,123,829

- Greenwood – $235,643

- Harvard – $8,104,372

- Hebron – $1,080,000

- Holiday Hills – $524,929

- Huntley – $22,329,839

- Island Lake – $6,919,851

- Johnsburg – $524,929

- Lake in the Hills – $24,709,899

- Lakemoor – $5,199,122

- Lakewood – $3,383,688

- Marengo – $6,5236,911

- McCullom Lake – $524,929

- McHenry – $22,974,452

- Oakwood Hills – $1,784,034

- Port Barrington – $1,317,065

- Prairie Grove – $1,646,868

- Richmond – $1,659,654

- Ringwood – $718,679

- Spring Grove – $4,881,670

- Trout Valley – $454,942

- Union – $490,079

- Wonder Lake – $3,438,423

- Woodstock – $21,526,318

The municipal search engine is here.

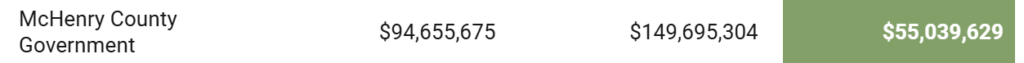

McHenry County’s twelve-year loss was $55 million.

All counties can be found at this search engine.