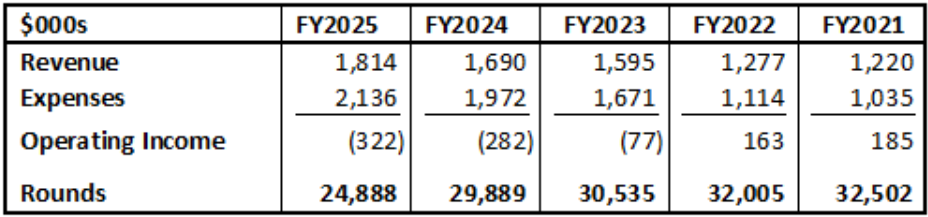

The fiscal year 2025 audit shows that RedTail lost money again, $322,000.

The golf course has now lost money in six of the last eight years.

The loss includes $34,000 in interest expense on the $2.8 million that Lakewood borrowed for the new clubhouse.

Interest expense for FY2025 was only for a few months.

RedTail Golf Club’s “Event,” not “Banquet” Hall.

This year interest expense will probably be around $110,000.

The loss doesn’t include the $78,000 in principal that the Village had to pay on the loan.

RedTail bar and restaurant.

That’s real money, but not an “expense” in accounting terms.

Including interest, it looks like taxpayers will be on the hook for around $170,000 this year.

Lakewood Village Board members asked no questions after a remote presentation of last year’s audit.

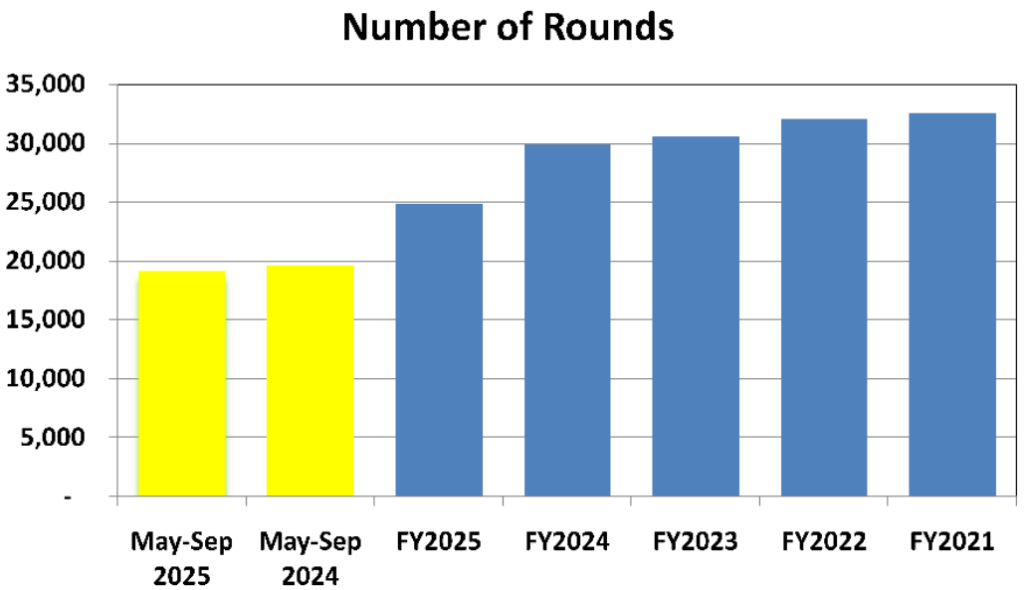

The number of rounds played declined in each of the last four years.

The number of rounds played was down 6% in FY2025 and down 23% from the peak in FY2021.

For the summer season this year, May through September, rounds were down another 2.4%.

I am still smarting at the extra $500 per year in taxes I paid for the purchase of the golf club for about fifteen of the twenty year bond after being told it would not cost me “a dime.”

The same kind of real estate taxed bonds were sold to pay for the clubhouse.

Color me skeptical that my real estate taxes will not be hiked to fill in the difference between golf club revenue and the cost of repaying interest and principal for building the clubhouse.