With the second installment of property taxes due on September 10th, let’s take a look at what the average bill was last year. (There’s always a lag in getting real estate tax statistics.)

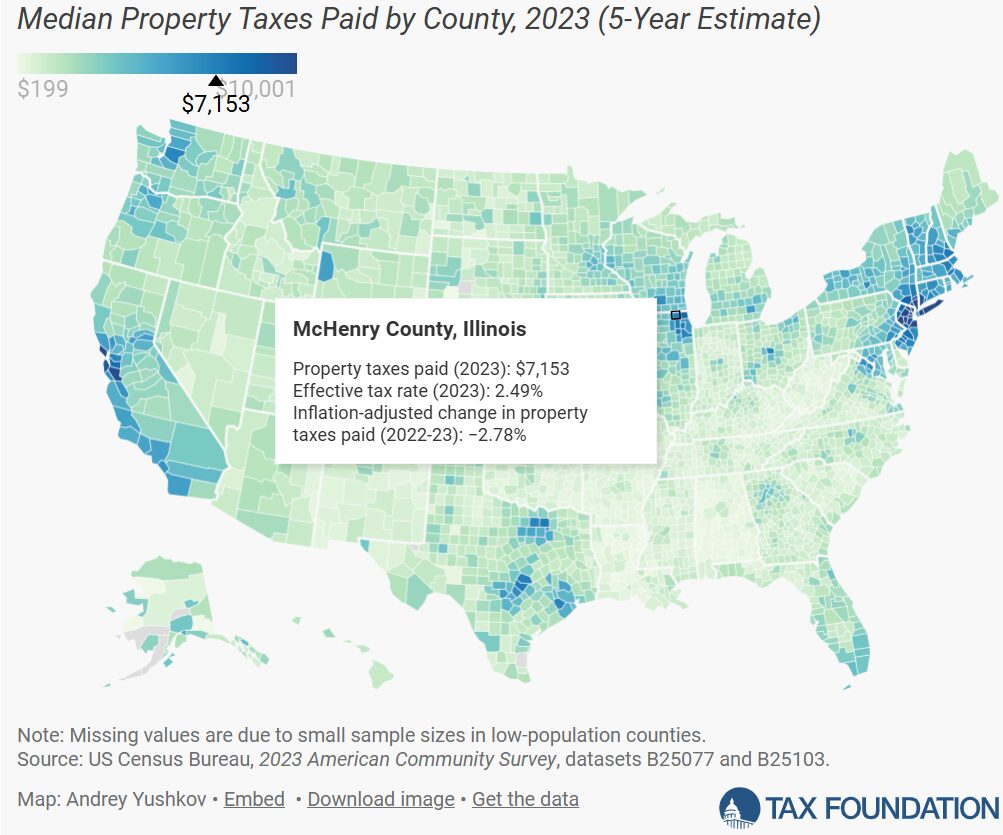

From the Tax foundation comes this information about the effective tax rate in McHenry County for taxes paid last year: 2.49%.

That means the average home in McHenry County pays about 2.5% of what it is worth (what it would sell for) in taxes in the year in question.

Of course, there are plenty of home with tax bills above average–half in fact.

There are somewhere in the neighborhood of 15,000 with bills above $10,000, the previous limit for deductions under the income tax bill that probably cost Peter Roskam his seat in Congress.

The logic of Roskam and the other Republicans that imposed the $10,000 limit was that high tax states (mainly Democratic Party-controlled ones) should not be subsidized through the Federal tax code by people in states where government was more economical.

As usual, I’m taking my tax payment to the Post Office and mailing it to the Treasurer’s Office at 2200 N. Seminary, Woodstock, IL 60098, rather than to the bank in Carol Stream requested on the bill.

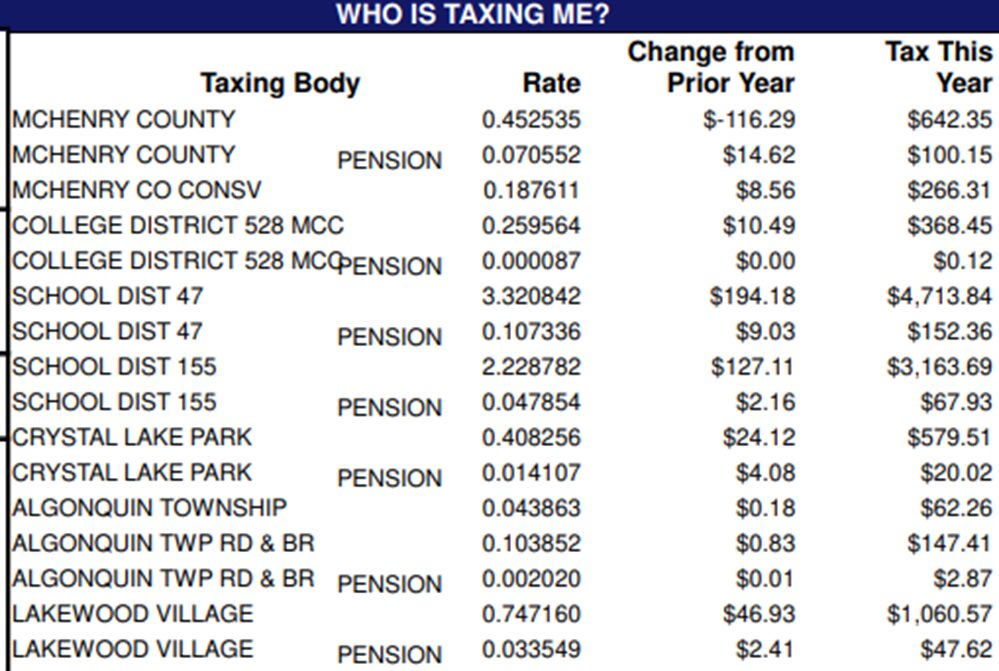

That will give me more time to come up with the money to pay our bill, elements of which you can see below: