Illinois Policy has an excellent article on property taxes, which ran here yesterday.

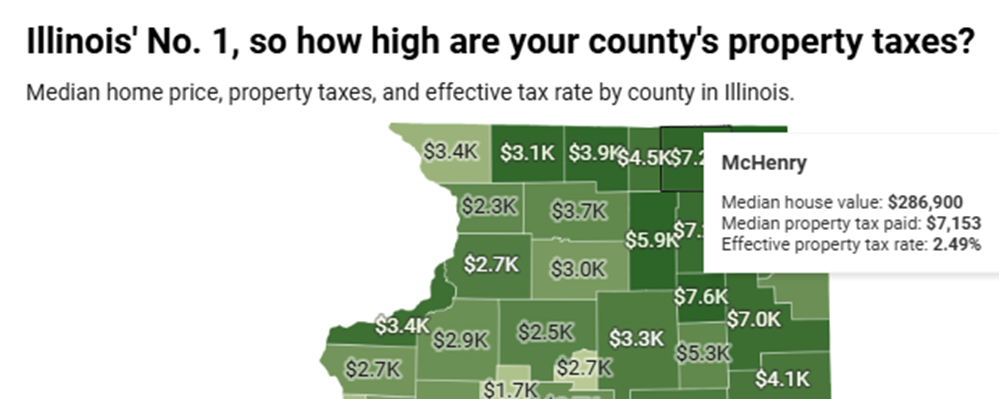

There is an interactive map of information about every county in Illinois.

This information can be found for every county on Illinois Policy’s map.

Assuming most people will not take the time to compare area counties, here is what I found concerning effective tax rates. One’s effective tax rate is determined by dividing one’s tax bill by the value of one’s home.

The effective tax rate figures below are averages:

- Lake County – 2.68%

- Kendall County – 2.53%

- McHenry County – 2.49%

- Winnebago – 2.48%

- Kane County – 2.39%

- Will County – 2.35%

- Boone County – 2.27%

- DuPage County – 2.09%

- Cook County – 1.98%